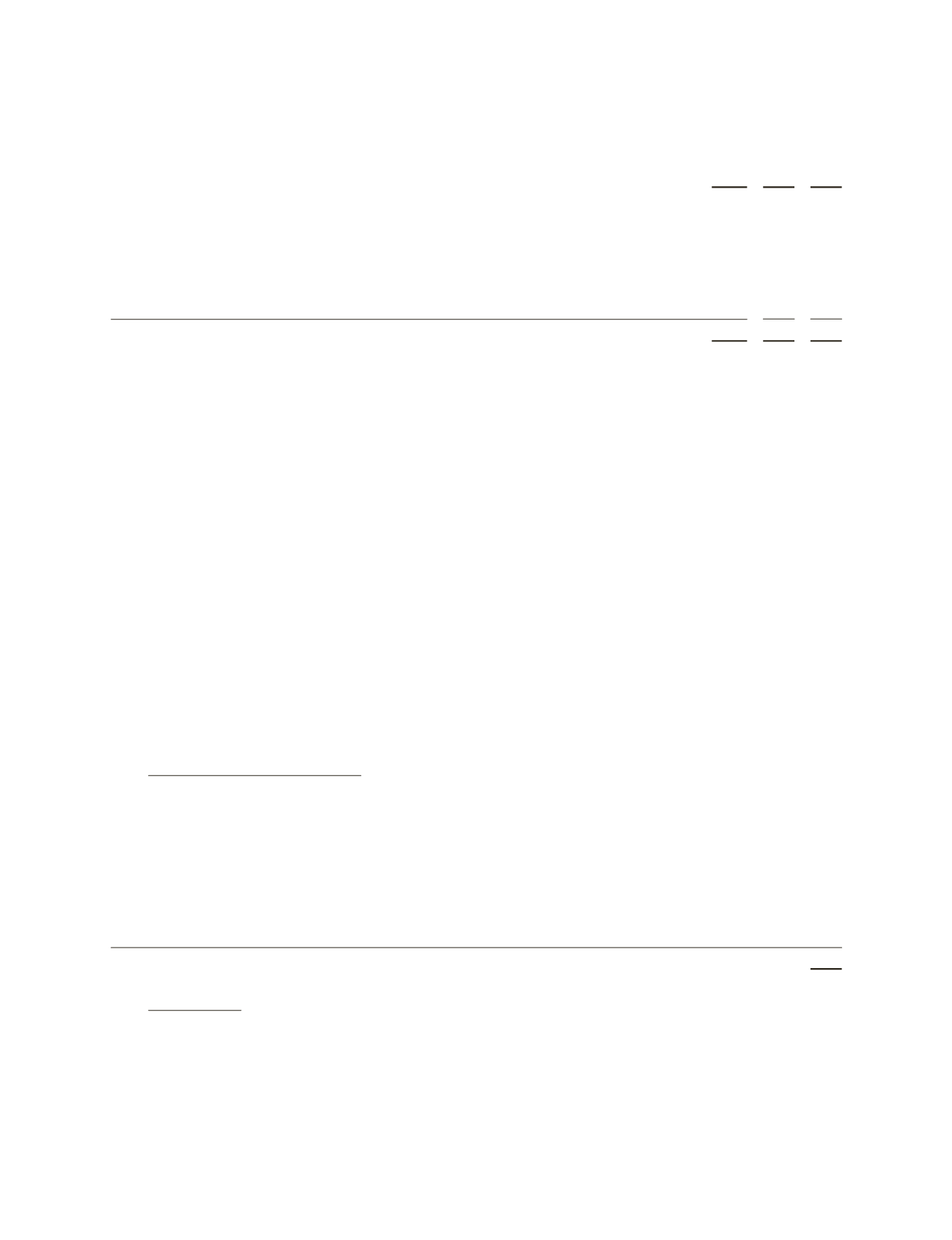

A reconciliation of the beginning and ending amount of liabilities associated with uncertain tax positions for the

years ended December 31, 2012, 2011 and 2010 is as follows:

(Stated in millions)

2012

2011 2010

Balance at beginning of year

$1,353

$1,338 $1,026

Additions based on tax positions related to the current year

156

153

190

Additions for tax positions of prior years

98

49

8

Additions related to acquisitions

–

48

288

Impact of changes in exchange rates

12

(18)

(3)

Settlements with tax authorities

(17)

(77)

(36)

Reductions for tax positions of prior years

(103)

(102)

(99)

Reductions due to the lapse of the applicable statute of limitations

(46)

(38)

(36)

Balance at end of year

$1,453

$1,353 $1,338

The amounts above exclude accrued interest and penalties of $250 million, $225 million and $210 million at

December 31, 2012, 2011 and 2010 respectively.

Schlumberger classifies interest and penalties relating to uncertain tax positions within

Taxes on income

in the

Consolidated Statement of Income

. During 2012, 2011 and 2010, Schlumberger recognized approximately $25 million,

$15 million and $42 million in interest and penalties, respectively.

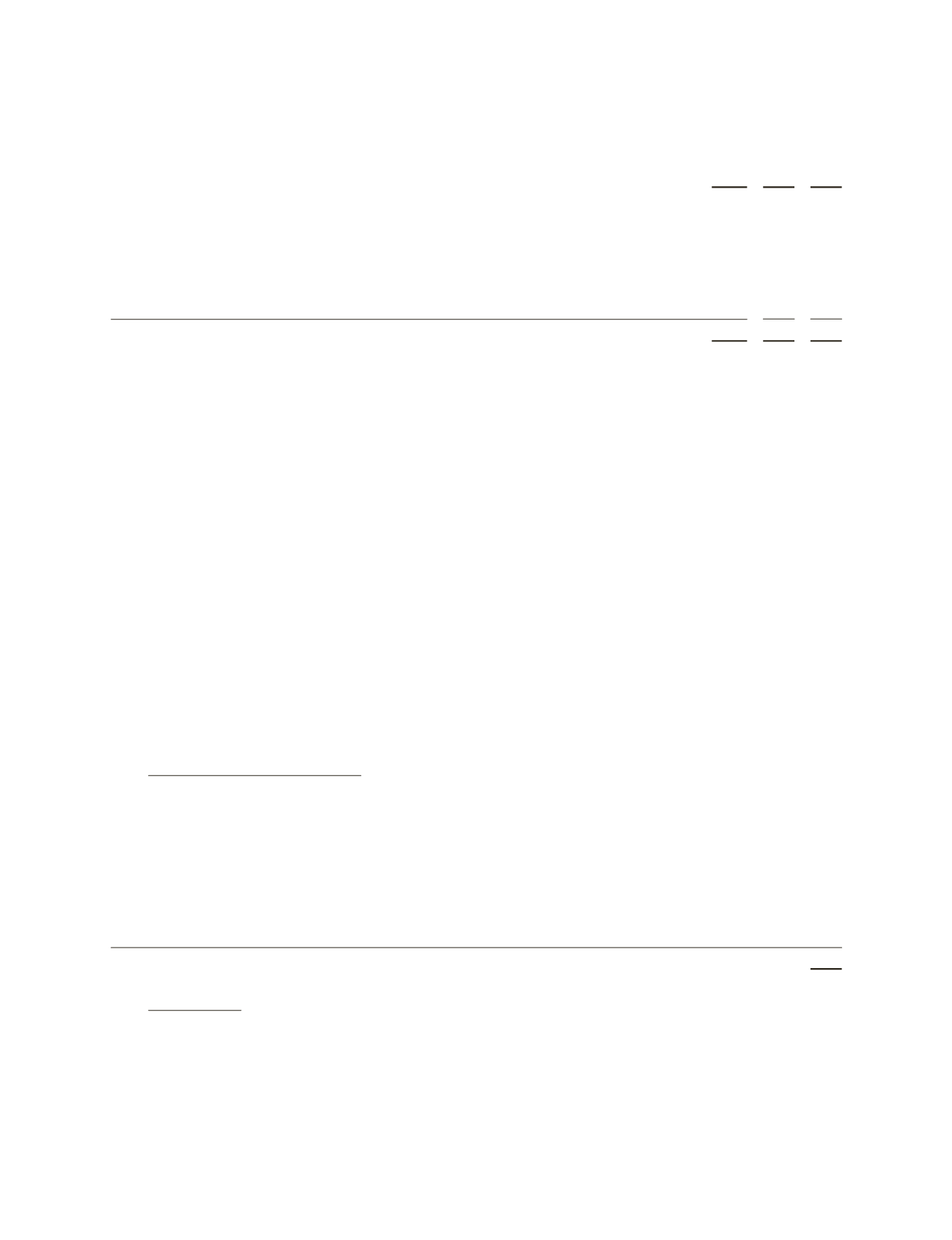

The following table summarizes the tax years that are either currently under audit or remain open and subject to

examination by the tax authorities in the most significant jurisdictions in which Schlumberger operates:

Brazil

2006 – 2012

Canada

2005 – 2012

Mexico

2007 – 2012

Norway

2003 – 2012

Russia

2009 – 2012

Saudi Arabia

2001 – 2012

United Kingdom

2009 – 2012

United States

2008 – 2012

In certain of the jurisdictions noted above, Schlumberger operates through more than one legal entity, each of which

has different open years subject to examination. The table above presents the open years subject to examination for

the most material of the legal entities in each jurisdiction. Additionally, it is important to note that tax years are

technically not closed until the statute of limitations in each jurisdiction expires. In the jurisdictions noted above, the

statute of limitations can extend beyond the open years subject to examination.

15. Leases and Lease Commitments

Total rental expense was $1.9 billion in 2012, $1.6 billion in 2011, and $1.2 billion in 2010. Future minimum rental

commitments under noncancelable operating leases for each of the next five years are as follows:

(Stated in millions)

2013

$ 371

2014

250

2015

192

2016

154

2017

129

Thereafter

519

$1,615

16. Contingencies

In 2007, Schlumberger received an inquiry from the United States Department of Justice (“DOJ”) related to the

DOJ’s investigation of whether certain freight forwarding and customs clearance services of Panalpina, Inc., and other

companies provided to oil and oilfield service companies, including Schlumberger, violated the Foreign Corrupt

Practices Act. In October 2012, Schlumberger was advised by the DOJ that it has closed its inquiry as it relates to

Schlumberger.

55