- Page 1

- Page 2

- Page 3

- Page 4

- Page 5

- Page 6

- Page 7

- Page 8

- Page 9

- Page 10

- Page 11

- Page 12

- Page 13

- Page 14

- Page 15

- Page 16

- Page 17

- Page 18

- Page 19

- Page 20

- Page 21

- Page 22

- Page 23

- Page 24

- Page 25

- Page 26

- Page 27

- Page 28

- Page 29

- Page 30

- Page 31

- Page 32

- Page 33

- Page 34

- Page 35

- Page 36

- Page 37

- Page 38

- Page 39

- Page 40

- Page 41

- Page 42

- Page 43

- Page 44

- Page 45

- Page 46

- Page 47

- Page 48

- Page 49

- Page 50

- Page 51

- Page 52

- Page 53

- Page 54

- Page 55

- Page 56

- Page 57

- Page 58

- Page 59

- Page 60

- Page 61

- Page 62

- Page 63

- Page 64

- Page 65

- Page 66

- Page 67

- Page 68

- Page 69

- Page 70

- Page 71

- Page 72

- Page 73

- Page 74

- Page 75

- Page 76

- Page 77

- Page 78

- Page 79

- Page 80

- Flash version

© UniFlip.com

- Page 2

- Page 3

- Page 4

- Page 5

- Page 6

- Page 7

- Page 8

- Page 9

- Page 10

- Page 11

- Page 12

- Page 13

- Page 14

- Page 15

- Page 16

- Page 17

- Page 18

- Page 19

- Page 20

- Page 21

- Page 22

- Page 23

- Page 24

- Page 25

- Page 26

- Page 27

- Page 28

- Page 29

- Page 30

- Page 31

- Page 32

- Page 33

- Page 34

- Page 35

- Page 36

- Page 37

- Page 38

- Page 39

- Page 40

- Page 41

- Page 42

- Page 43

- Page 44

- Page 45

- Page 46

- Page 47

- Page 48

- Page 49

- Page 50

- Page 51

- Page 52

- Page 53

- Page 54

- Page 55

- Page 56

- Page 57

- Page 58

- Page 59

- Page 60

- Page 61

- Page 62

- Page 63

- Page 64

- Page 65

- Page 66

- Page 67

- Page 68

- Page 69

- Page 70

- Page 71

- Page 72

- Page 73

- Page 74

- Page 75

- Page 76

- Page 77

- Page 78

- Page 79

- Page 80

- Flash version

© UniFlip.com

and 2011. Our ARS investments at September 30, 2012 consisted of two tax exempt municipal debt securities with a total par value of $8,225. The ARS market began to experience illiquidity in early 2008, and this illiquidity continues. Despite this lack of liquidity, there have been no defaults of the underlying securities and interest income on these holdings continues to be received on scheduled interest payment dates. Our ARS, when purchased, were generally issued by A-rated municipalities. Although the credit ratings of both municipalities have been downgraded since our original investment, the ARS are credit enhanced with bond insurance and currently carry a credit rating of AA- by Standard and Poors. Since an active market for ARS does not currently exist, we determine the fair value of these investments using a Level 3 discounted cash flow analysis and also consider other factors such as the reduced liquidity in the ARS market and nature of the insurance backing. Key inputs to our discounted cash flow model include projected cash flows from interest and principal payments and the weighted probabilities of improved liquidity or debt refinancing by the issuer. We also incorporate certain Level 2 market indices into the discounted cash flow analysis, including published rates such as the LIBOR rate, the LIBOR swap curve and a municipal swap index published by the Securities Industry and Financial Markets Association. The following table presents a reconciliation of the activity in fiscal 2012 for fair value measurements using level 3 inputs:

Balance as of September 30, 2011 Net sales of ARS Balance as of September 30, 2012 $ 8,041 (50) $7,991

the continued insurance backing, and have concluded the impairment we have maintained remains adequate and temporary. See Note 7 for more information on these investments.

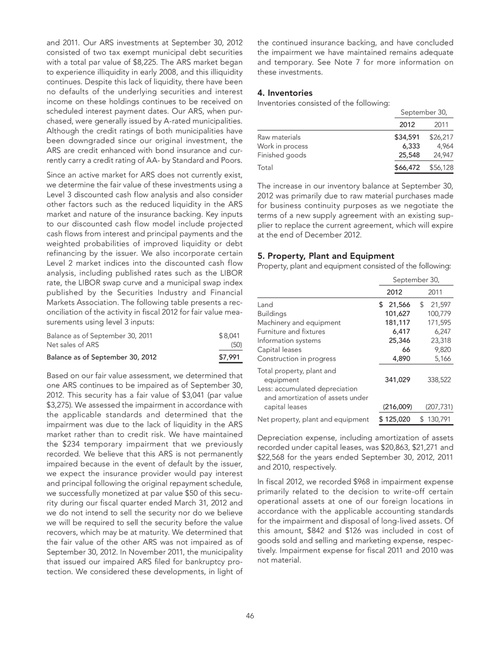

4. Inventories

Inventories consisted of the following:

September 30, 2012 Raw materials Work in process Finished goods Total $ 34,591 6,333 25,548 $ 66,472 2011 $ 26,217 4,964 24,947 $ 56,128

The increase in our inventory balance at September 30, 2012 was primarily due to raw material purchases made for business continuity purposes as we negotiate the terms of a new supply agreement with an existing supplier to replace the current agreement, which will expire at the end of December 2012.

5. Property, Plant and Equipment

Property, plant and equipment consisted of the following:

September 30, 2012 Land Buildings Machinery and equipment Furniture and fixtures Information systems Capital leases Construction in progress Total property, plant and equipment Less: accumulated depreciation and amortization of assets under capital leases Net property, plant and equipment $ 21,566 101,627 181,117 6,417 25,346 66 4,890 341,029 $ 2011 21,597 100,779 171,595 6,247 23,318 9,820 5,166 338,522

Based on our fair value assessment, we determined that one ARS continues to be impaired as of September 30, 2012. This security has a fair value of $3,041 (par value $3,275). We assessed the impairment in accordance with the applicable standards and determined that the impairment was due to the lack of liquidity in the ARS market rather than to credit risk. We have maintained the $234 temporary impairment that we previously recorded. We believe that this ARS is not permanently impaired because in the event of default by the issuer, we expect the insurance provider would pay interest and principal following the original repayment schedule, we successfully monetized at par value $50 of this security during our fiscal quarter ended March 31, 2012 and we do not intend to sell the security nor do we believe we will be required to sell the security before the value recovers, which may be at maturity. We determined that the fair value of the other ARS was not impaired as of September 30, 2012. In November 2011, the municipality that issued our impaired ARS filed for bankruptcy protection. We considered these developments, in light of

(216,009) $ 125,020

(207,731) $ 130,791

Depreciation expense, including amortization of assets recorded under capital leases, was $20,863, $21,271 and $22,568 for the years ended September 30, 2012, 2011 and 2010, respectively. In fiscal 2012, we recorded $968 in impairment expense primarily related to the decision to write-off certain operational assets at one of our foreign locations in accordance with the applicable accounting standards for the impairment and disposal of long-lived assets. Of this amount, $842 and $126 was included in cost of goods sold and selling and marketing expense, respectively. Impairment expense for fiscal 2011 and 2010 was not material.

46