- Page 1

- Page 2

- Page 3

- Page 4

- Page 5

- Page 6

- Page 7

- Page 8

- Page 9

- Page 10

- Page 11

- Page 12

- Page 13

- Page 14

- Page 15

- Page 16

- Page 17

- Page 18

- Page 19

- Page 20

- Page 21

- Page 22

- Page 23

- Page 24

- Page 25

- Page 26

- Page 27

- Page 28

- Page 29

- Page 30

- Page 31

- Page 32

- Page 33

- Page 34

- Page 35

- Page 36

- Page 37

- Page 38

- Page 39

- Page 40

- Page 41

- Page 42

- Page 43

- Page 44

- Page 45

- Page 46

- Page 47

- Page 48

- Page 49

- Page 50

- Page 51

- Page 52

- Page 53

- Page 54

- Page 55

- Page 56

- Page 57

- Page 58

- Page 59

- Page 60

- Page 61

- Page 62

- Page 63

- Page 64

- Page 65

- Page 66

- Page 67

- Page 68

- Page 69

- Page 70

- Page 71

- Page 72

- Page 73

- Page 74

- Page 75

- Page 76

- Page 77

- Page 78

- Page 79

- Page 80

- Flash version

© UniFlip.com

- Page 2

- Page 3

- Page 4

- Page 5

- Page 6

- Page 7

- Page 8

- Page 9

- Page 10

- Page 11

- Page 12

- Page 13

- Page 14

- Page 15

- Page 16

- Page 17

- Page 18

- Page 19

- Page 20

- Page 21

- Page 22

- Page 23

- Page 24

- Page 25

- Page 26

- Page 27

- Page 28

- Page 29

- Page 30

- Page 31

- Page 32

- Page 33

- Page 34

- Page 35

- Page 36

- Page 37

- Page 38

- Page 39

- Page 40

- Page 41

- Page 42

- Page 43

- Page 44

- Page 45

- Page 46

- Page 47

- Page 48

- Page 49

- Page 50

- Page 51

- Page 52

- Page 53

- Page 54

- Page 55

- Page 56

- Page 57

- Page 58

- Page 59

- Page 60

- Page 61

- Page 62

- Page 63

- Page 64

- Page 65

- Page 66

- Page 67

- Page 68

- Page 69

- Page 70

- Page 71

- Page 72

- Page 73

- Page 74

- Page 75

- Page 76

- Page 77

- Page 78

- Page 79

- Page 80

- Flash version

© UniFlip.com

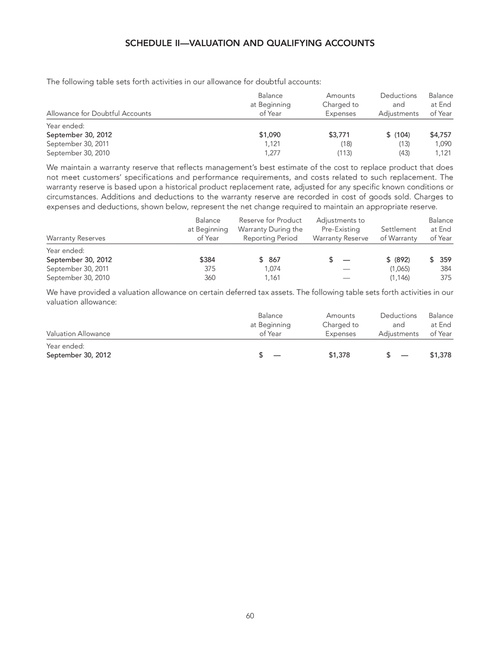

SCHEDULE II—VALUATION AND QUALIFYING ACCOUNTS

The following table sets forth activities in our allowance for doubtful accounts:

Balance at Beginning of Year $1,090 1,121 1,277 Amounts Charged to Expenses $3,771 (18) (113) Deductions and Adjustments $ (104) (13) (43) Balance at End of Year $4,757 1,090 1,121

Allowance for Doubtful Accounts Year ended: September 30, 2012 September 30, 2011 September 30, 2010

We maintain a warranty reserve that reflects management’s best estimate of the cost to replace product that does not meet customers’ specifications and performance requirements, and costs related to such replacement. The warranty reserve is based upon a historical product replacement rate, adjusted for any specific known conditions or circumstances. Additions and deductions to the warranty reserve are recorded in cost of goods sold. Charges to expenses and deductions, shown below, represent the net change required to maintain an appropriate reserve.

Balance at Beginning of Year $384 375 360 Reserve for Product Warranty During the Reporting Period $ 867 1,074 1,161 Adjustments to Pre-Existing Warranty Reserve $ — — — Settlement of Warranty $ (892) (1,065) (1,146) Balance at End of Year $ 359 384 375

Warranty Reserves Year ended: September 30, 2012 September 30, 2011 September 30, 2010

We have provided a valuation allowance on certain deferred tax assets. The following table sets forth activities in our valuation allowance:

Balance at Beginning of Year $ — Amounts Charged to Expenses $1,378 Deductions and Adjustments $ — Balance at End of Year $1,378

Valuation Allowance Year ended: September 30, 2012

60