- Page 1

- Page 2

- Page 3

- Page 4

- Page 5

- Page 6

- Page 7

- Page 8

- Page 9

- Page 10

- Page 11

- Page 12

- Page 13

- Page 14

- Page 15

- Page 16

- Page 17

- Page 18

- Page 19

- Page 20

- Page 21

- Page 22

- Page 23

- Page 24

- Page 25

- Page 26

- Page 27

- Page 28

- Page 29

- Page 30

- Page 31

- Page 32

- Page 33

- Page 34

- Page 35

- Page 36

- Page 37

- Page 38

- Page 39

- Page 40

- Page 41

- Page 42

- Page 43

- Page 44

- Page 45

- Page 46

- Page 47

- Page 48

- Page 49

- Page 50

- Page 51

- Page 52

- Page 53

- Page 54

- Page 55

- Page 56

- Page 57

- Page 58

- Page 59

- Page 60

- Page 61

- Page 62

- Page 63

- Page 64

- Page 65

- Page 66

- Page 67

- Page 68

- Page 69

- Page 70

- Page 71

- Page 72

- Page 73

- Page 74

- Page 75

- Page 76

- Page 77

- Page 78

- Page 79

- Page 80

- Flash version

© UniFlip.com

- Page 2

- Page 3

- Page 4

- Page 5

- Page 6

- Page 7

- Page 8

- Page 9

- Page 10

- Page 11

- Page 12

- Page 13

- Page 14

- Page 15

- Page 16

- Page 17

- Page 18

- Page 19

- Page 20

- Page 21

- Page 22

- Page 23

- Page 24

- Page 25

- Page 26

- Page 27

- Page 28

- Page 29

- Page 30

- Page 31

- Page 32

- Page 33

- Page 34

- Page 35

- Page 36

- Page 37

- Page 38

- Page 39

- Page 40

- Page 41

- Page 42

- Page 43

- Page 44

- Page 45

- Page 46

- Page 47

- Page 48

- Page 49

- Page 50

- Page 51

- Page 52

- Page 53

- Page 54

- Page 55

- Page 56

- Page 57

- Page 58

- Page 59

- Page 60

- Page 61

- Page 62

- Page 63

- Page 64

- Page 65

- Page 66

- Page 67

- Page 68

- Page 69

- Page 70

- Page 71

- Page 72

- Page 73

- Page 74

- Page 75

- Page 76

- Page 77

- Page 78

- Page 79

- Page 80

- Flash version

© UniFlip.com

program. As of December 13, 2011, we had $82,869 remaining under this share repurchase program. In conjunction with a new capital management initiative, on December 13, 2011, our Board of Directors authorized an increase in the amount available under our share repurchase program to $150,000. With this increased authorization, as of September 30, 2012, $130,000 remains outstanding under our share repurchase program. Shares are repurchased from time to time, depending on market conditions, in open market transactions, at management’s discretion. We repurchased 564,568 shares for $25,000 in fiscal 2011 under a prior share repurchase program, which was completed during the fiscal quarter ended March 31, 2011. During fiscal 2010, we repurchased 723,184 shares of common stock under this prior program at a cost of $24,998. To date, we have funded share repurchases under our share repurchase program from our existing cash balance, and anticipate we will continue to do so. The program, which became effective on the authorization date, may be suspended or terminated at any time, at the Company’s discretion. For additional information on share repurchases, see Part II, Item 5. “Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities”. Separate from this share repurchase program, a total of 37,304, 33,840 and 24,651 shares were purchased during fiscal 2012, 2011 and 2010, respectively, pursuant to the terms of our EIP and OIP as shares withheld from award recipients to cover payroll taxes on the vesting of shares of restricted stock granted under the EIP and OIP.

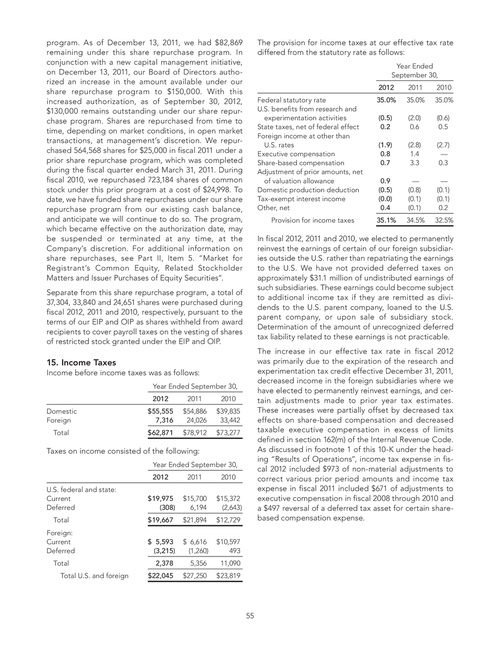

The provision for income taxes at our effective tax rate differed from the statutory rate as follows:

Year Ended September 30, 2012 Federal statutory rate U.S. benefits from research and experimentation activities State taxes, net of federal effect Foreign income at other than U.S. rates Executive compensation Share-based compensation Adjustment of prior amounts, net of valuation allowance Domestic production deduction Tax-exempt interest income Other, net Provision for income taxes 35.0% (0.5) 0.2 (1.9) 0.8 0.7 0.9 (0.5) (0.0) 0.4 35.1% 2011 35.0% (2.0) 0.6 (2.8) 1.4 3.3 — (0.8) (0.1) (0.1) 34.5% 2010 35.0% (0.6) 0.5 (2.7) — 0.3 — (0.1) (0.1) 0.2 32.5%

In fiscal 2012, 2011 and 2010, we elected to permanently reinvest the earnings of certain of our foreign subsidiaries outside the U.S. rather than repatriating the earnings to the U.S. We have not provided deferred taxes on approximately $31.1 million of undistributed earnings of such subsidiaries. These earnings could become subject to additional income tax if they are remitted as dividends to the U.S. parent company, loaned to the U.S. parent company, or upon sale of subsidiary stock. Determination of the amount of unrecognized deferred tax liability related to these earnings is not practicable. The increase in our effective tax rate in fiscal 2012 was primarily due to the expiration of the research and experimentation tax credit effective December 31, 2011, decreased income in the foreign subsidiaries where we have elected to permanently reinvest earnings, and certain adjustments made to prior year tax estimates. These increases were partially offset by decreased tax effects on share-based compensation and decreased taxable executive compensation in excess of limits defined in section 162(m) of the Internal Revenue Code. As discussed in footnote 1 of this 10-K under the heading “Results of Operations”, income tax expense in fiscal 2012 included $973 of non-material adjustments to correct various prior period amounts and income tax expense in fiscal 2011 included $671 of adjustments to executive compensation in fiscal 2008 through 2010 and a $497 reversal of a deferred tax asset for certain sharebased compensation expense.

15. Income Taxes

Income before income taxes was as follows:

Year Ended September 30, 2012 Domestic Foreign Total $ 55,555 7,316 $ 62,871 2011 $ 54,886 24,026 $ 78,912 2010 $ 39,835 33,442 $ 73,277

Taxes on income consisted of the following:

Year Ended September 30, 2012 U.S. federal and state: Current Deferred Total Foreign: Current Deferred Total Total U.S. and foreign $ 19,975 (308) $ 19,667 $ 5,593 (3,215) 2,378 $ 22,045 2011 $ 15,700 6,194 $ 21,894 $ 6,616 (1,260) 5,356 $ 27,250 2010 $ 15,372 (2,643) $ 12,729 $ 10,597 493 11,090 $ 23,819

55