- Page 1

- Page 2

- Page 3

- Page 4

- Page 5

- Page 6

- Page 7

- Page 8

- Page 9

- Page 10

- Page 11

- Page 12

- Page 13

- Page 14

- Page 15

- Page 16

- Page 17

- Page 18

- Page 19

- Page 20

- Page 21

- Page 22

- Page 23

- Page 24

- Page 25

- Page 26

- Page 27

- Page 28

- Page 29

- Page 30

- Page 31

- Page 32

- Page 33

- Page 34

- Page 35

- Page 36

- Page 37

- Page 38

- Page 39

- Page 40

- Page 41

- Page 42

- Page 43

- Page 44

- Page 45

- Page 46

- Page 47

- Page 48

- Page 49

- Page 50

- Page 51

- Page 52

- Page 53

- Page 54

- Page 55

- Page 56

- Page 57

- Page 58

- Page 59

- Page 60

- Page 61

- Page 62

- Page 63

- Page 64

- Page 65

- Page 66

- Page 67

- Page 68

- Page 69

- Page 70

- Page 71

- Page 72

- Page 73

- Page 74

- Page 75

- Page 76

- Page 77

- Page 78

- Page 79

- Page 80

- Flash version

© UniFlip.com

- Page 2

- Page 3

- Page 4

- Page 5

- Page 6

- Page 7

- Page 8

- Page 9

- Page 10

- Page 11

- Page 12

- Page 13

- Page 14

- Page 15

- Page 16

- Page 17

- Page 18

- Page 19

- Page 20

- Page 21

- Page 22

- Page 23

- Page 24

- Page 25

- Page 26

- Page 27

- Page 28

- Page 29

- Page 30

- Page 31

- Page 32

- Page 33

- Page 34

- Page 35

- Page 36

- Page 37

- Page 38

- Page 39

- Page 40

- Page 41

- Page 42

- Page 43

- Page 44

- Page 45

- Page 46

- Page 47

- Page 48

- Page 49

- Page 50

- Page 51

- Page 52

- Page 53

- Page 54

- Page 55

- Page 56

- Page 57

- Page 58

- Page 59

- Page 60

- Page 61

- Page 62

- Page 63

- Page 64

- Page 65

- Page 66

- Page 67

- Page 68

- Page 69

- Page 70

- Page 71

- Page 72

- Page 73

- Page 74

- Page 75

- Page 76

- Page 77

- Page 78

- Page 79

- Page 80

- Flash version

© UniFlip.com

12. Savings Plan

Effective in May 2000, we adopted the Cabot Microelectronics Corporation 401(k) Plan (the “401(k) Plan”), which is a qualified defined contribution plan, covering all eligible U.S. employees meeting certain minimum age and eligibility requirements, as defined by the 401(k) Plan. Participants may make elective contributions of up to 60% of their eligible compensation. All amounts contributed by participants and earnings on these contributions are fully vested at all times. The 401(k) Plan provides for matching and fixed non-elective contributions by the Company. Under the 401(k) Plan, the Company will match 100% of the first four percent of the participant’s eligible compensation and 50% of the next two percent of the participant’s eligible compensation that is contributed, subject to limitations required by government regulations. Under the 401(k) Plan, all U.S. employees, even those who do not contribute to the 401(k) Plan, receive a contribution by the Company in an amount equal to four percent of eligible compensation, and thus are participants in the 401(k) Plan. Participants are 100% vested in all Company contributions at all times. The Company’s expense for the 401(k) Plan totaled $4,210, $4,201 and $2,981 for the fiscal years ended September 30, 2012, 2011 and 2010, respectively.

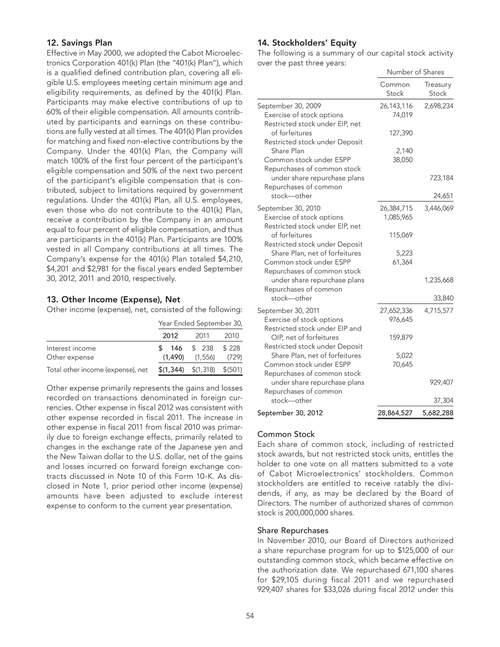

14. Stockholders’ Equity

The following is a summary of our capital stock activity over the past three years:

Number of Shares Common Stock September 30, 2009 Exercise of stock options Restricted stock under EIP, net of forfeitures Restricted stock under Deposit Share Plan Common stock under ESPP Repurchases of common stock under share repurchase plans Repurchases of common stock—other September 30, 2010 Exercise of stock options Restricted stock under EIP, net of forfeitures Restricted stock under Deposit Share Plan, net of forfeitures Common stock under ESPP Repurchases of common stock under share repurchase plans Repurchases of common stock—other September 30, 2011 Exercise of stock options Restricted stock under EIP and OIP, net of forfeitures Restricted stock under Deposit Share Plan, net of forfeitures Common stock under ESPP Repurchases of common stock under share repurchase plans Repurchases of common stock—other September 30, 2012 26,143,116 74,019 127,390 2,140 38,050 723,184 24,651 26,384,715 1,085,965 115,069 5,223 61,364 1,235,668 33,840 27,652,336 976,645 159,879 5,022 70,645 929,407 37,304 28,864,527 5,682,288 4,715,577 3,446,069 Treasury Stock 2,698,234

13. Other Income (Expense), Net

Other income (expense), net, consisted of the following:

Year Ended September 30, 2012 Interest income Other expense Total other income (expense), net $ 146 (1,490) 2011 $ 238 (1,556) $(1,318) 2010 $ 228 (729) $ (501)

$ (1,344)

Other expense primarily represents the gains and losses recorded on transactions denominated in foreign currencies. Other expense in fiscal 2012 was consistent with other expense recorded in fiscal 2011. The increase in other expense in fiscal 2011 from fiscal 2010 was primarily due to foreign exchange effects, primarily related to changes in the exchange rate of the Japanese yen and the New Taiwan dollar to the U.S. dollar, net of the gains and losses incurred on forward foreign exchange contracts discussed in Note 10 of this Form 10-K. As disclosed in Note 1, prior period other income (expense) amounts have been adjusted to exclude interest expense to conform to the current year presentation.

Common Stock

Each share of common stock, including of restricted stock awards, but not restricted stock units, entitles the holder to one vote on all matters submitted to a vote of Cabot Microelectronics’ stockholders. Common stockholders are entitled to receive ratably the dividends, if any, as may be declared by the Board of Directors. The number of authorized shares of common stock is 200,000,000 shares.

Share Repurchases

In November 2010, our Board of Directors authorized a share repurchase program for up to $125,000 of our outstanding common stock, which became effective on the authorization date. We repurchased 671,100 shares for $29,105 during fiscal 2011 and we repurchased 929,407 shares for $33,026 during fiscal 2012 under this

54