- Page 1

- Page 2

- Page 3

- Page 4

- Page 5

- Page 6

- Page 7

- Page 8

- Page 9

- Page 10

- Page 11

- Page 12

- Page 13

- Page 14

- Page 15

- Page 16

- Page 17

- Page 18

- Page 19

- Page 20

- Page 21

- Page 22

- Page 23

- Page 24

- Page 25

- Page 26

- Page 27

- Page 28

- Page 29

- Page 30

- Page 31

- Page 32

- Page 33

- Page 34

- Page 35

- Page 36

- Page 37

- Page 38

- Page 39

- Page 40

- Page 41

- Page 42

- Page 43

- Page 44

- Page 45

- Page 46

- Page 47

- Page 48

- Page 49

- Page 50

- Page 51

- Page 52

- Page 53

- Page 54

- Page 55

- Page 56

- Page 57

- Page 58

- Page 59

- Page 60

- Page 61

- Page 62

- Page 63

- Page 64

- Page 65

- Page 66

- Page 67

- Page 68

- Page 69

- Page 70

- Page 71

- Page 72

- Page 73

- Page 74

- Page 75

- Page 76

- Page 77

- Page 78

- Page 79

- Page 80

- Flash version

© UniFlip.com

- Page 2

- Page 3

- Page 4

- Page 5

- Page 6

- Page 7

- Page 8

- Page 9

- Page 10

- Page 11

- Page 12

- Page 13

- Page 14

- Page 15

- Page 16

- Page 17

- Page 18

- Page 19

- Page 20

- Page 21

- Page 22

- Page 23

- Page 24

- Page 25

- Page 26

- Page 27

- Page 28

- Page 29

- Page 30

- Page 31

- Page 32

- Page 33

- Page 34

- Page 35

- Page 36

- Page 37

- Page 38

- Page 39

- Page 40

- Page 41

- Page 42

- Page 43

- Page 44

- Page 45

- Page 46

- Page 47

- Page 48

- Page 49

- Page 50

- Page 51

- Page 52

- Page 53

- Page 54

- Page 55

- Page 56

- Page 57

- Page 58

- Page 59

- Page 60

- Page 61

- Page 62

- Page 63

- Page 64

- Page 65

- Page 66

- Page 67

- Page 68

- Page 69

- Page 70

- Page 71

- Page 72

- Page 73

- Page 74

- Page 75

- Page 76

- Page 77

- Page 78

- Page 79

- Page 80

- Flash version

© UniFlip.com

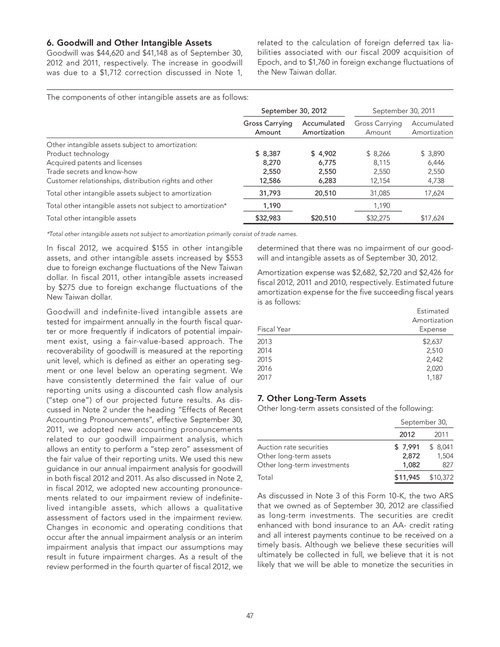

6. Goodwill and Other Intangible Assets

Goodwill was $44,620 and $41,148 as of September 30, 2012 and 2011, respectively. The increase in goodwill was due to a $1,712 correction discussed in Note 1, The components of other intangible assets are as follows:

related to the calculation of foreign deferred tax liabilities associated with our fiscal 2009 acquisition of Epoch, and to $1,760 in foreign exchange fluctuations of the New Taiwan dollar.

September 30, 2012 Gross Carrying Amount Other intangible assets subject to amortization: Product technology Acquired patents and licenses Trade secrets and know-how Customer relationships, distribution rights and other Total other intangible assets subject to amortization Total other intangible assets not subject to amortization* Total other intangible assets $ 8,387 8,270 2,550 12,586 31,793 1,190 $32,983 $20,510 Accumulated Amortization $ 4,902 6,775 2,550 6,283 20,510

September 30, 2011 Gross Carrying Amount $ 8,266 8,115 2,550 12,154 31,085 1,190 $32,275 $17,624 Accumulated Amortization $ 3,890 6,446 2,550 4,738 17,624

*Total other intangible assets not subject to amortization primarily consist of trade names.

In fiscal 2012, we acquired $155 in other intangible assets, and other intangible assets increased by $553 due to foreign exchange fluctuations of the New Taiwan dollar. In fiscal 2011, other intangible assets increased by $275 due to foreign exchange fluctuations of the New Taiwan dollar. Goodwill and indefinite-lived intangible assets are tested for impairment annually in the fourth fiscal quarter or more frequently if indicators of potential impairment exist, using a fair-value-based approach. The recoverability of goodwill is measured at the reporting unit level, which is defined as either an operating segment or one level below an operating segment. We have consistently determined the fair value of our reporting units using a discounted cash flow analysis (“step one”) of our projected future results. As discussed in Note 2 under the heading “Effects of Recent Accounting Pronouncements”, effective September 30, 2011, we adopted new accounting pronouncements related to our goodwill impairment analysis, which allows an entity to perform a “step zero” assessment of the fair value of their reporting units. We used this new guidance in our annual impairment analysis for goodwill in both fiscal 2012 and 2011. As also discussed in Note 2, in fiscal 2012, we adopted new accounting pronouncements related to our impairment review of indefinitelived intangible assets, which allows a qualitative assessment of factors used in the impairment review. Changes in economic and operating conditions that occur after the annual impairment analysis or an interim impairment analysis that impact our assumptions may result in future impairment charges. As a result of the review performed in the fourth quarter of fiscal 2012, we

determined that there was no impairment of our goodwill and intangible assets as of September 30, 2012. Amortization expense was $2,682, $2,720 and $2,426 for fiscal 2012, 2011 and 2010, respectively. Estimated future amortization expense for the five succeeding fiscal years is as follows:

Fiscal Year 2013 2014 2015 2016 2017 Estimated Amortization Expense $2,637 2,510 2,442 2,020 1,187

7. Other Long-Term Assets

Other long-term assets consisted of the following:

September 30, 2012 Auction rate securities Other long-term assets Other long-term investments Total $ 7,991 2,872 1,082 $ 11,945 2011 $ 8,041 1,504 827 $ 10,372

As discussed in Note 3 of this Form 10-K, the two ARS that we owned as of September 30, 2012 are classified as long-term investments. The securities are credit enhanced with bond insurance to an AA- credit rating and all interest payments continue to be received on a timely basis. Although we believe these securities will ultimately be collected in full, we believe that it is not likely that we will be able to monetize the securities in

47