- Page 1

- Page 2

- Page 3

- Page 4

- Page 5

- Page 6

- Page 7

- Page 8

- Page 9

- Page 10

- Page 11

- Page 12

- Page 13

- Page 14

- Page 15

- Page 16

- Page 17

- Page 18

- Page 19

- Page 20

- Page 21

- Page 22

- Page 23

- Page 24

- Page 25

- Page 26

- Page 27

- Page 28

- Page 29

- Page 30

- Page 31

- Page 32

- Page 33

- Page 34

- Page 35

- Page 36

- Page 37

- Page 38

- Page 39

- Page 40

- Page 41

- Page 42

- Page 43

- Page 44

- Page 45

- Page 46

- Page 47

- Page 48

- Page 49

- Page 50

- Page 51

- Page 52

- Page 53

- Page 54

- Page 55

- Page 56

- Page 57

- Page 58

- Page 59

- Page 60

- Page 61

- Page 62

- Page 63

- Page 64

- Page 65

- Page 66

- Page 67

- Page 68

- Page 69

- Page 70

- Page 71

- Page 72

- Page 73

- Page 74

- Page 75

- Page 76

- Page 77

- Page 78

- Page 79

- Page 80

- Flash version

© UniFlip.com

- Page 2

- Page 3

- Page 4

- Page 5

- Page 6

- Page 7

- Page 8

- Page 9

- Page 10

- Page 11

- Page 12

- Page 13

- Page 14

- Page 15

- Page 16

- Page 17

- Page 18

- Page 19

- Page 20

- Page 21

- Page 22

- Page 23

- Page 24

- Page 25

- Page 26

- Page 27

- Page 28

- Page 29

- Page 30

- Page 31

- Page 32

- Page 33

- Page 34

- Page 35

- Page 36

- Page 37

- Page 38

- Page 39

- Page 40

- Page 41

- Page 42

- Page 43

- Page 44

- Page 45

- Page 46

- Page 47

- Page 48

- Page 49

- Page 50

- Page 51

- Page 52

- Page 53

- Page 54

- Page 55

- Page 56

- Page 57

- Page 58

- Page 59

- Page 60

- Page 61

- Page 62

- Page 63

- Page 64

- Page 65

- Page 66

- Page 67

- Page 68

- Page 69

- Page 70

- Page 71

- Page 72

- Page 73

- Page 74

- Page 75

- Page 76

- Page 77

- Page 78

- Page 79

- Page 80

- Flash version

© UniFlip.com

dividend. The cumulative number of shares designated under the ESPP was increased by a factor of 1.45068 representing the ratio of the official NASDAQ closing price of $51.92 per share on the dividend payment date, to the official NASDAQ opening price of $35.79 per share on the ex-dividend date. As of September 30, 2012, a total of 814,625 shares are available for purchase under the ESPP. The ESPP allows all full-time, and certain part-time, employees of our Company and its subsidiaries to purchase shares of our common stock through payroll deductions. Employees can elect to have up to 10% of their annual earnings withheld to purchase our stock, subject to a maximum number of shares that a participant may purchase and a maximum dollar expenditure in any six-month offering period, and certain other criteria. The provisions of the ESPP allow shares to be purchased at a price no less than the lower of 85% of the closing price at the beginning or end of each semi-annual stock purchase period. A total of 70,645, 61,364, and 38,050 shares were issued under the ESPP during fiscal 2012, 2011 and 2010, respectively. Compensation expense related to the ESPP was $735, $508 and $360 in fiscal 2012, 2011 and 2010, respectively.

Directors’ Deferred Compensation Plan

The Directors’ Deferred Compensation Plan (DDCP), as amended and restated September 23, 2008, became effective in March 2001 and applies only to our nonemployee directors. The cumulative number of shares deferred under the plan was 71,781 and 47,530 as of September 30, 2012 and 2011, respectively. The DDCP required us to proportionally adjust the cumulative number of shares deferred under the plan to reflect the effect of the leveraged recapitalization with a special cash dividend. The cumulative number of shares deferred under the DDCP was increased by a factor of 1.45068 representing the ratio of the official NASDAQ closing price of $51.92 per share on the dividend payment date, to the official NASDAQ opening price of $35.79 per share on the ex-dividend date. Compensation expense related to the DDCP was $95, $83 and $68 for fiscal 2012, 2011 and 2010, respectively.

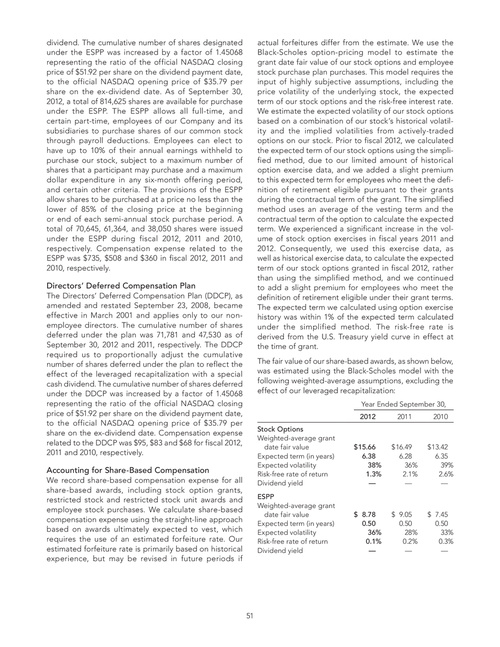

actual forfeitures differ from the estimate. We use the Black-Scholes option-pricing model to estimate the grant date fair value of our stock options and employee stock purchase plan purchases. This model requires the input of highly subjective assumptions, including the price volatility of the underlying stock, the expected term of our stock options and the risk-free interest rate. We estimate the expected volatility of our stock options based on a combination of our stock’s historical volatility and the implied volatilities from actively-traded options on our stock. Prior to fiscal 2012, we calculated the expected term of our stock options using the simplified method, due to our limited amount of historical option exercise data, and we added a slight premium to this expected term for employees who meet the definition of retirement eligible pursuant to their grants during the contractual term of the grant. The simplified method uses an average of the vesting term and the contractual term of the option to calculate the expected term. We experienced a significant increase in the volume of stock option exercises in fiscal years 2011 and 2012. Consequently, we used this exercise data, as well as historical exercise data, to calculate the expected term of our stock options granted in fiscal 2012, rather than using the simplified method, and we continued to add a slight premium for employees who meet the definition of retirement eligible under their grant terms. The expected term we calculated using option exercise history was within 1% of the expected term calculated under the simplified method. The risk-free rate is derived from the U.S. Treasury yield curve in effect at the time of grant. The fair value of our share-based awards, as shown below, was estimated using the Black-Scholes model with the following weighted-average assumptions, excluding the effect of our leveraged recapitalization:

Year Ended September 30, 2012 Stock Options Weighted-average grant date fair value Expected term (in years) Expected volatility Risk-free rate of return Dividend yield ESPP Weighted-average grant date fair value Expected term (in years) Expected volatility Risk-free rate of return Dividend yield 2011 2010

Accounting for Share-Based Compensation

We record share-based compensation expense for all share-based awards, including stock option grants, restricted stock and restricted stock unit awards and employee stock purchases. We calculate share-based compensation expense using the straight-line approach based on awards ultimately expected to vest, which requires the use of an estimated forfeiture rate. Our estimated forfeiture rate is primarily based on historical experience, but may be revised in future periods if

$ 15.66 6.38 38% 1.3% —

$ 16.49 6.28 36% 2.1% —

$ 13.42 6.35 39% 2.6% —

$ 8.78 0.50 36% 0.1% —

$ 9.05 0.50 28% 0.2% —

$ 7.45 0.50 33% 0.3% —

51