- Page 1

- Page 2

- Page 3

- Page 4

- Page 5

- Page 6

- Page 7

- Page 8

- Page 9

- Page 10

- Page 11

- Page 12

- Page 13

- Page 14

- Page 15

- Page 16

- Page 17

- Page 18

- Page 19

- Page 20

- Page 21

- Page 22

- Page 23

- Page 24

- Page 25

- Page 26

- Page 27

- Page 28

- Page 29

- Page 30

- Page 31

- Page 32

- Page 33

- Page 34

- Page 35

- Page 36

- Page 37

- Page 38

- Page 39

- Page 40

- Page 41

- Page 42

- Page 43

- Page 44

- Page 45

- Page 46

- Page 47

- Page 48

- Page 49

- Page 50

- Page 51

- Page 52

- Page 53

- Page 54

- Page 55

- Page 56

- Page 57

- Page 58

- Page 59

- Page 60

- Page 61

- Page 62

- Page 63

- Page 64

- Page 65

- Page 66

- Page 67

- Page 68

- Page 69

- Page 70

- Page 71

- Page 72

- Page 73

- Page 74

- Page 75

- Page 76

- Page 77

- Page 78

- Page 79

- Page 80

- Flash version

© UniFlip.com

- Page 2

- Page 3

- Page 4

- Page 5

- Page 6

- Page 7

- Page 8

- Page 9

- Page 10

- Page 11

- Page 12

- Page 13

- Page 14

- Page 15

- Page 16

- Page 17

- Page 18

- Page 19

- Page 20

- Page 21

- Page 22

- Page 23

- Page 24

- Page 25

- Page 26

- Page 27

- Page 28

- Page 29

- Page 30

- Page 31

- Page 32

- Page 33

- Page 34

- Page 35

- Page 36

- Page 37

- Page 38

- Page 39

- Page 40

- Page 41

- Page 42

- Page 43

- Page 44

- Page 45

- Page 46

- Page 47

- Page 48

- Page 49

- Page 50

- Page 51

- Page 52

- Page 53

- Page 54

- Page 55

- Page 56

- Page 57

- Page 58

- Page 59

- Page 60

- Page 61

- Page 62

- Page 63

- Page 64

- Page 65

- Page 66

- Page 67

- Page 68

- Page 69

- Page 70

- Page 71

- Page 72

- Page 73

- Page 74

- Page 75

- Page 76

- Page 77

- Page 78

- Page 79

- Page 80

- Flash version

© UniFlip.com

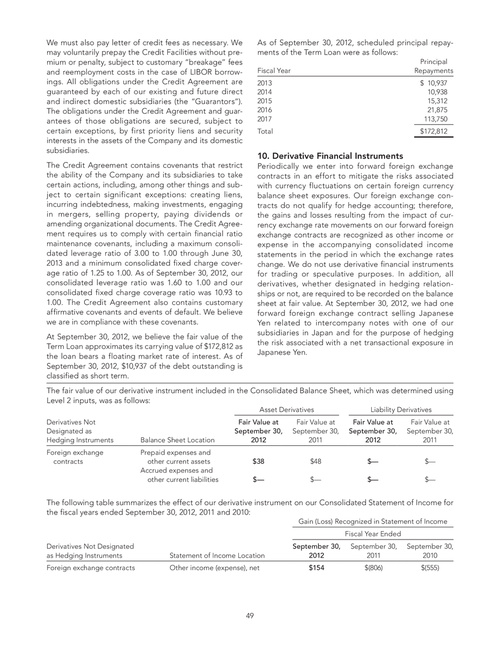

We must also pay letter of credit fees as necessary. We may voluntarily prepay the Credit Facilities without premium or penalty, subject to customary “breakage” fees and reemployment costs in the case of LIBOR borrowings. All obligations under the Credit Agreement are guaranteed by each of our existing and future direct and indirect domestic subsidiaries (the “Guarantors”). The obligations under the Credit Agreement and guarantees of those obligations are secured, subject to certain exceptions, by first priority liens and security interests in the assets of the Company and its domestic subsidiaries. The Credit Agreement contains covenants that restrict the ability of the Company and its subsidiaries to take certain actions, including, among other things and subject to certain significant exceptions: creating liens, incurring indebtedness, making investments, engaging in mergers, selling property, paying dividends or amending organizational documents. The Credit Agreement requires us to comply with certain financial ratio maintenance covenants, including a maximum consolidated leverage ratio of 3.00 to 1.00 through June 30, 2013 and a minimum consolidated fixed charge coverage ratio of 1.25 to 1.00. As of September 30, 2012, our consolidated leverage ratio was 1.60 to 1.00 and our consolidated fixed charge coverage ratio was 10.93 to 1.00. The Credit Agreement also contains customary affirmative covenants and events of default. We believe we are in compliance with these covenants. At September 30, 2012, we believe the fair value of the Term Loan approximates its carrying value of $172,812 as the loan bears a floating market rate of interest. As of September 30, 2012, $10,937 of the debt outstanding is classified as short term.

As of September 30, 2012, scheduled principal repayments of the Term Loan were as follows:

Fiscal Year 2013 2014 2015 2016 2017 Total Principal Repayments $ 10,937 10,938 15,312 21,875 113,750 $172,812

10. Derivative Financial Instruments

Periodically we enter into forward foreign exchange contracts in an effort to mitigate the risks associated with currency fluctuations on certain foreign currency balance sheet exposures. Our foreign exchange contracts do not qualify for hedge accounting; therefore, the gains and losses resulting from the impact of currency exchange rate movements on our forward foreign exchange contracts are recognized as other income or expense in the accompanying consolidated income statements in the period in which the exchange rates change. We do not use derivative financial instruments for trading or speculative purposes. In addition, all derivatives, whether designated in hedging relationships or not, are required to be recorded on the balance sheet at fair value. At September 30, 2012, we had one forward foreign exchange contract selling Japanese Yen related to intercompany notes with one of our subsidiaries in Japan and for the purpose of hedging the risk associated with a net transactional exposure in Japanese Yen.

The fair value of our derivative instrument included in the Consolidated Balance Sheet, which was determined using Level 2 inputs, was as follows:

Asset Derivatives Derivatives Not Designated as Hedging Instruments Foreign exchange contracts Fair Value at September 30, 2012 $38 $— Fair Value at September 30, 2011 $48 $— Liability Derivatives Fair Value at September 30, 2012 $— $— Fair Value at September 30, 2011 $— $—

Balance Sheet Location Prepaid expenses and other current assets Accrued expenses and other current liabilities

The following table summarizes the effect of our derivative instrument on our Consolidated Statement of Income for the fiscal years ended September 30, 2012, 2011 and 2010:

Gain (Loss) Recognized in Statement of Income Fiscal Year Ended Derivatives Not Designated as Hedging Instruments Foreign exchange contracts Statement of Income Location Other income (expense), net September 30, 2012 $154 September 30, 2011 $(806) September 30, 2010 $(555)

49