- Page 1

- Page 2

- Page 3

- Page 4

- Page 5

- Page 6

- Page 7

- Page 8

- Page 9

- Page 10

- Page 11

- Page 12

- Page 13

- Page 14

- Page 15

- Page 16

- Page 17

- Page 18

- Page 19

- Page 20

- Page 21

- Page 22

- Page 23

- Page 24

- Page 25

- Page 26

- Page 27

- Page 28

- Page 29

- Page 30

- Page 31

- Page 32

- Page 33

- Page 34

- Page 35

- Page 36

- Page 37

- Page 38

- Page 39

- Page 40

- Page 41

- Page 42

- Page 43

- Page 44

- Page 45

- Page 46

- Page 47

- Page 48

- Page 49

- Page 50

- Page 51

- Page 52

- Page 53

- Page 54

- Page 55

- Page 56

- Page 57

- Page 58

- Page 59

- Page 60

- Page 61

- Page 62

- Page 63

- Page 64

- Page 65

- Page 66

- Page 67

- Page 68

- Page 69

- Page 70

- Page 71

- Page 72

- Page 73

- Page 74

- Page 75

- Page 76

- Page 77

- Page 78

- Page 79

- Page 80

- Flash version

© UniFlip.com

- Page 2

- Page 3

- Page 4

- Page 5

- Page 6

- Page 7

- Page 8

- Page 9

- Page 10

- Page 11

- Page 12

- Page 13

- Page 14

- Page 15

- Page 16

- Page 17

- Page 18

- Page 19

- Page 20

- Page 21

- Page 22

- Page 23

- Page 24

- Page 25

- Page 26

- Page 27

- Page 28

- Page 29

- Page 30

- Page 31

- Page 32

- Page 33

- Page 34

- Page 35

- Page 36

- Page 37

- Page 38

- Page 39

- Page 40

- Page 41

- Page 42

- Page 43

- Page 44

- Page 45

- Page 46

- Page 47

- Page 48

- Page 49

- Page 50

- Page 51

- Page 52

- Page 53

- Page 54

- Page 55

- Page 56

- Page 57

- Page 58

- Page 59

- Page 60

- Page 61

- Page 62

- Page 63

- Page 64

- Page 65

- Page 66

- Page 67

- Page 68

- Page 69

- Page 70

- Page 71

- Page 72

- Page 73

- Page 74

- Page 75

- Page 76

- Page 77

- Page 78

- Page 79

- Page 80

- Flash version

© UniFlip.com

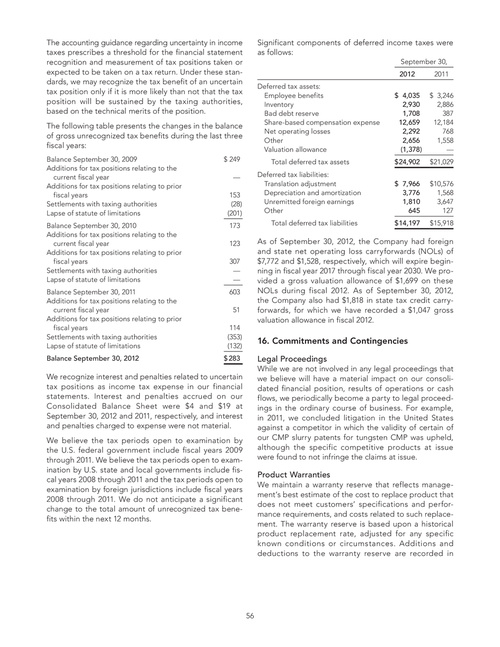

The accounting guidance regarding uncertainty in income taxes prescribes a threshold for the financial statement recognition and measurement of tax positions taken or expected to be taken on a tax return. Under these standards, we may recognize the tax benefit of an uncertain tax position only if it is more likely than not that the tax position will be sustained by the taxing authorities, based on the technical merits of the position. The following table presents the changes in the balance of gross unrecognized tax benefits during the last three fiscal years:

Balance September 30, 2009 Additions for tax positions relating to the current fiscal year Additions for tax positions relating to prior fiscal years Settlements with taxing authorities Lapse of statute of limitations Balance September 30, 2010 Additions for tax positions relating to the current fiscal year Additions for tax positions relating to prior fiscal years Settlements with taxing authorities Lapse of statute of limitations Balance September 30, 2011 Additions for tax positions relating to the current fiscal year Additions for tax positions relating to prior fiscal years Settlements with taxing authorities Lapse of statute of limitations Balance September 30, 2012 $ 249 — 153 (28) (201) 173 123 307 — — 603 51 114 (353) (132) $ 283

Significant components of deferred income taxes were as follows:

September 30, 2012 Deferred tax assets: Employee benefits Inventory Bad debt reserve Share-based compensation expense Net operating losses Other Valuation allowance Total deferred tax assets Deferred tax liabilities: Translation adjustment Depreciation and amortization Unremitted foreign earnings Other Total deferred tax liabilities $ 4,035 2,930 1,708 12,659 2,292 2,656 (1,378) $ 24,902 $ 7,966 3,776 1,810 645 $ 14,197 2011 $ 3,246 2,886 387 12,184 768 1,558 — $ 21,029 $ 10,576 1,568 3,647 127 $ 15,918

As of September 30, 2012, the Company had foreign and state net operating loss carryforwards (NOLs) of $7,772 and $1,528, respectively, which will expire beginning in fiscal year 2017 through fiscal year 2030. We provided a gross valuation allowance of $1,699 on these NOLs during fiscal 2012. As of September 30, 2012, the Company also had $1,818 in state tax credit carryforwards, for which we have recorded a $1,047 gross valuation allowance in fiscal 2012.

16. Commitments and Contingencies

Legal Proceedings

While we are not involved in any legal proceedings that we believe will have a material impact on our consolidated financial position, results of operations or cash flows, we periodically become a party to legal proceedings in the ordinary course of business. For example, in 2011, we concluded litigation in the United States against a competitor in which the validity of certain of our CMP slurry patents for tungsten CMP was upheld, although the specific competitive products at issue were found to not infringe the claims at issue.

We recognize interest and penalties related to uncertain tax positions as income tax expense in our financial statements. Interest and penalties accrued on our Consolidated Balance Sheet were $4 and $19 at September 30, 2012 and 2011, respectively, and interest and penalties charged to expense were not material. We believe the tax periods open to examination by the U.S. federal government include fiscal years 2009 through 2011. We believe the tax periods open to examination by U.S. state and local governments include fiscal years 2008 through 2011 and the tax periods open to examination by foreign jurisdictions include fiscal years 2008 through 2011. We do not anticipate a significant change to the total amount of unrecognized tax benefits within the next 12 months.

Product Warranties

We maintain a warranty reserve that reflects management’s best estimate of the cost to replace product that does not meet customers’ specifications and performance requirements, and costs related to such replacement. The warranty reserve is based upon a historical product replacement rate, adjusted for any specific known conditions or circumstances. Additions and deductions to the warranty reserve are recorded in

56