- Page 1

- Page 2

- Page 3

- Page 4

- Page 5

- Page 6

- Page 7

- Page 8

- Page 9

- Page 10

- Page 11

- Page 12

- Page 13

- Page 14

- Page 15

- Page 16

- Page 17

- Page 18

- Page 19

- Page 20

- Page 21

- Page 22

- Page 23

- Page 24

- Page 25

- Page 26

- Page 27

- Page 28

- Page 29

- Page 30

- Page 31

- Page 32

- Page 33

- Page 34

- Page 35

- Page 36

- Page 37

- Page 38

- Page 39

- Page 40

- Page 41

- Page 42

- Page 43

- Page 44

- Page 45

- Page 46

- Page 47

- Page 48

- Page 49

- Page 50

- Page 51

- Page 52

- Page 53

- Page 54

- Page 55

- Page 56

- Page 57

- Page 58

- Page 59

- Page 60

- Page 61

- Page 62

- Page 63

- Page 64

- Page 65

- Page 66

- Page 67

- Page 68

- Page 69

- Page 70

- Page 71

- Page 72

- Page 73

- Page 74

- Page 75

- Page 76

- Page 77

- Page 78

- Page 79

- Page 80

- Flash version

© UniFlip.com

- Page 2

- Page 3

- Page 4

- Page 5

- Page 6

- Page 7

- Page 8

- Page 9

- Page 10

- Page 11

- Page 12

- Page 13

- Page 14

- Page 15

- Page 16

- Page 17

- Page 18

- Page 19

- Page 20

- Page 21

- Page 22

- Page 23

- Page 24

- Page 25

- Page 26

- Page 27

- Page 28

- Page 29

- Page 30

- Page 31

- Page 32

- Page 33

- Page 34

- Page 35

- Page 36

- Page 37

- Page 38

- Page 39

- Page 40

- Page 41

- Page 42

- Page 43

- Page 44

- Page 45

- Page 46

- Page 47

- Page 48

- Page 49

- Page 50

- Page 51

- Page 52

- Page 53

- Page 54

- Page 55

- Page 56

- Page 57

- Page 58

- Page 59

- Page 60

- Page 61

- Page 62

- Page 63

- Page 64

- Page 65

- Page 66

- Page 67

- Page 68

- Page 69

- Page 70

- Page 71

- Page 72

- Page 73

- Page 74

- Page 75

- Page 76

- Page 77

- Page 78

- Page 79

- Page 80

- Flash version

© UniFlip.com

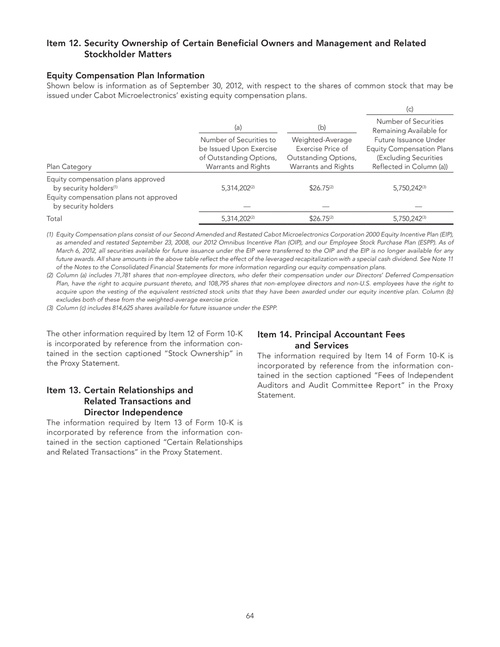

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

Equity Compensation Plan Information

Shown below is information as of September 30, 2012, with respect to the shares of common stock that may be issued under Cabot Microelectronics’ existing equity compensation plans.

(c) (a) Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights 5,314,202(2) — 5,314,202

(2)

(b) Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights $26.75(2) — $26.75

(2)

Plan Category Equity compensation plans approved by security holders(1) Equity compensation plans not approved by security holders Total

Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in Column (a)) 5,750,242(3) — 5,750,242(3)

(1) Equity Compensation plans consist of our Second Amended and Restated Cabot Microelectronics Corporation 2000 Equity Incentive Plan (EIP), as amended and restated September 23, 2008, our 2012 Omnibus Incentive Plan (OIP), and our Employee Stock Purchase Plan (ESPP). As of March 6, 2012, all securities available for future issuance under the EIP were transferred to the OIP and the EIP is no longer available for any future awards. All share amounts in the above table reflect the effect of the leveraged recapitalization with a special cash dividend. See Note 11 of the Notes to the Consolidated Financial Statements for more information regarding our equity compensation plans. (2) Column (a) includes 71,781 shares that non-employee directors, who defer their compensation under our Directors’ Deferred Compensation Plan, have the right to acquire pursuant thereto, and 108,795 shares that non-employee directors and non-U.S. employees have the right to acquire upon the vesting of the equivalent restricted stock units that they have been awarded under our equity incentive plan. Column (b) excludes both of these from the weighted-average exercise price. (3) Column (c) includes 814,625 shares available for future issuance under the ESPP.

The other information required by Item 12 of Form 10-K is incorporated by reference from the information contained in the section captioned “Stock Ownership” in the Proxy Statement.

Item 14. Principal Accountant Fees and Services

The information required by Item 14 of Form 10-K is incorporated by reference from the information contained in the section captioned “Fees of Independent Auditors and Audit Committee Report” in the Proxy Statement.

Item 13. Certain Relationships and Related Transactions and Director Independence

The information required by Item 13 of Form 10-K is incorporated by reference from the information contained in the section captioned “Certain Relationships and Related Transactions” in the Proxy Statement.

64